So, you’re looking at buying a mobile home – congratulations!

No matter where you’re relocating to, you may consider moving into a mobile home park. With any park or community, there are bound to be questions from any homebuyer along the way. After all, the park that your future mobile home will reside in is just as important as the home itself, so any prospective homebuyer will want to ensure they’re moving into a park or community that’s just right for them.

Finding the Right Community For You

Before you start your search for the perfect mobile home, it’s important to create a checklist of your top priorities when it comes to living in a mobile home park. These could include:

- Finding a community that allows for pets if you own a dog, cat, or other animal

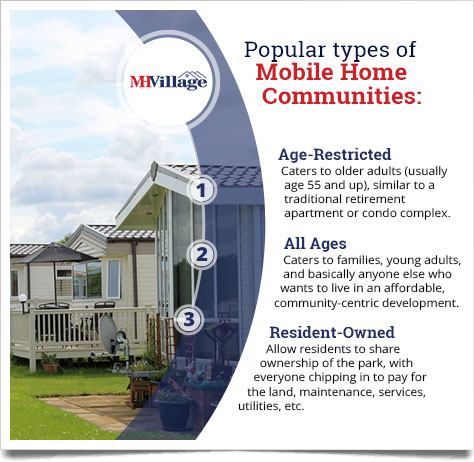

- Finding an age-restricted community, if desired

- Having access to amenities such as a swimming pool, lakeside view, facilities such as racquetball or tennis courts, etc.

- The level of gated security within a community

- Whether or not a park is resident-owned

MHVillage makes it easy to search for a mobile home park that meets your specific needs. There are filters for parks with pet-friendly accommodations, on-site pools and clubhouses, and parks exclusively for residents over the age of 55. Even though homes in today’s housing market are in very high demand, that doesn’t mean you should have to compromise when it comes to buying your mobile home.

Contacting the Community

Once you’ve found a mobile home park or community that fits your needs, the next step is to contact the community to arrange a tour of the home, or to share any questions you may have. Most communities will have an email or phone number that you can reach – and for mobile home parks listed on MHVillage, you’ll have the option to contact the seller directly through their listing.

From there, a staff member from the park – sometimes a selling agent or a retailer that works directly with the park – can usually help you arrange a tour of the mobile home you’re interested in.

Touring the Home and Community

Like with any prospective home, you’ll want to take a tour of the mobile home for sale to see if it will be right for you and your personal preferences. Of course, you’ll also want to ensure that the mobile home is well-maintained and take note of any repairs needed, should you choose to purchase the home.

Consider some of the following questions you should ask yourself when touring a mobile home:

- Will I have enough space with this home?

- Can I afford the monthly expenses, such as utilities?

- Can I renovate it if I need to?

- Can I adequately address any issues with plumbing, electricity, or other utilities?

- Does the mobile home offer easy access to amenities and stores in the surrounding area that are important to me?

Some parks may offer virtual tours, too, that allow you to view the mobile home from the comfort of your own home. In addition to any photos that are available of the home, a virtual tour can consist of interactive, 360-degree photos and videos that walk you through the mobile home and its features.

If it’s possible, you may want to take a tour of the mobile home park or community you have in mind to see it for yourself. This way, you’ll be able to see how the mobile homes are laid out within the community, and check out the common facilities while you’re at it. This also gives you the chance to talk with any of the park’s residents and learn firsthand what it’s like living day-to-day in the community.

Securing a Lender and Financing

However, if you haven’t yet done so, you’ll want to connect with a lender to help you navigate the financial side of the mobile home buying process. This includes, but is not limited to:

- Ensuring your credit score will allow you to take out a mobile home loan

- Processing all necessary payments throughout the homebuying process

- Finding the right mobile home insurance for you

The MHVillage Mobile Home Buyer’s Guide offers further details on the financing options at your disposal. This also includes the various types of financing that may be available to you, including mobile home loans with land. For mobile homes situated in a park, chattel mortgages will often be the go-to.

Filling Out the Paperwork

If you’ve decided to purchase a mobile home, congratulations! Once you’ve had an offer accepted on a mobile home, that’s when the paperwork begins – and the exact documents you’ll sign may differ, depending on the process.

The first piece of paper you’ll sign after your offer has been accepted is usually the purchase agreement, which outlines the sale against contingencies such as the home inspection, financing approval, and a proper appraisal. Around this time, your lender will open an escrow account for your earnest money deposit (EMD). Think of an EMD as the down payment on the down payment.

While it’s very possible that your mobile home has already been appraised and inspected if it’s on the market, more often than not you’ll also want to hire an inspector and appraiser to verify the condition and value of the home. These will give you peace of mind in knowing that your new mobile home is priced appropriately, and will tell you more about the condition of your home, inside and out.

Once these two steps are set, it’s time to close! You’ll usually meet with the seller to sign your closing paperwork, which includes the final purchase contract as well as the title transfer itself, and any necessary tax-related documents.

During this step, your agent may also provide you with paperwork specific to your mobile home park, such as a signed contract acknowledging park guidelines and, if applicable, a renter’s agreement. Check with your park management for specific documents you’ll need to sign during this step.

Other types of paperwork may vary based on state. For instance, in Michigan, a notary wouldn’t need to present for a bill of sale, whereas other states may require this. Your lender or agent will be able to advise you here.

Extra Cost Considerations

Closing Costs

There is no one-size-fits-all answer when it comes to how much you should set aside for the down payment and closing costs, which includes your EMD. A lot of this depends on what kind of loan you and your lender agree on.

Generally speaking, you’ll want to budget around 5% of the asking price of the mobile home for your down payment, and another 5% for your closing costs. Your final out-of-pocket costs may not be quite as high, but it’s better to budget for more than you need. Any extra money you may have can go towards your first mortgage payment, moving expenses, or any needed home improvements.

Lot Costs

When moving into a mobile home park, you’ll likely come across additional monthly costs related to the park itself.

Lot rent (also known as a site fee) is probably the most common monthly payment you’ll make when living in a mobile home park. If your mortgage payments are what you pay for the mobile home itself, imagine the lot rent as the monthly payment for the lot on which your home sits.

Much like with your closing costs, there’s no one definitive answer as to how much your lot rent will cost. However, lot rent sometimes includes many utilities, such as water and sewage, internet access, electricity, and garbage pickup.

If you live in a resident-owned community, you may also pay a monthly or annual fee that goes toward community developments, such as community home repairs or building new amenities.

The mobile home park you choose to live in should have amenities that meet your needs, be in a quality neighborhood, and help make your manufactured or mobile home feel more like…well, home.